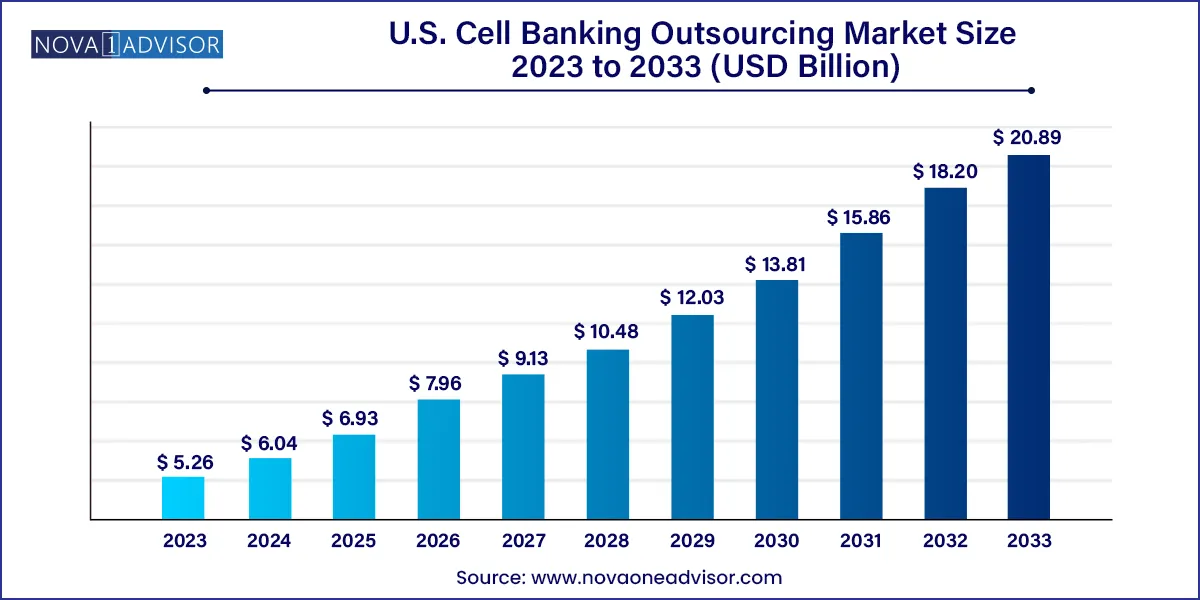

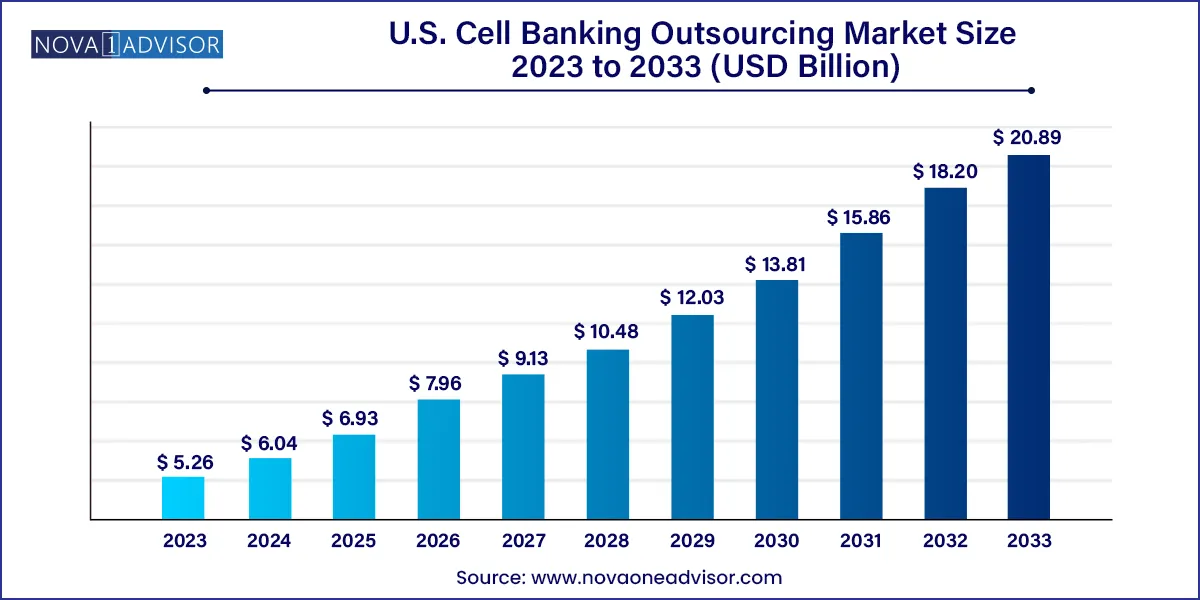

The U.S. cell banking outsourcing market size was estimated at USD 5.26 billion in 2023 and is projected to hit around USD 20.89 billion by 2033, growing at a CAGR of 14.79% during the forecast period from 2024 to 2033.

Key Takeaways:

- Based on type, master cell banking dominated the market with a share of 64.9% in 2023

- Working cell banking is projected to expand at the fastest CAGR from 2024 to 2033.

- Based on cell type, stem cell type held the largest share in 2023 and is expected to witness growth at the fastest CAGR over the forecast period

- Non-cell stem type is anticipated to expand at a significant CAGR from 2024 to 2033.

- Based on phase, bank storage dominated the market with a share of 44.11% in 2023.

- Bank characterization& testing is projected to grow at the largest CAGR from 2024 to 2033.

Market Overview

The U.S. cell banking outsourcing market is a vital and rapidly advancing segment of the broader life sciences and biopharmaceutical ecosystem. As cell-based research and therapies gain prominence in the modern medical and biotechnology landscape, the need for high-quality, reliable, and compliant cell banks has become paramount. Cell banking refers to the preservation of cells at a specific point in time, enabling their use in future manufacturing, research, diagnostics, or therapeutic applications. Outsourcing this function allows research organizations, pharmaceutical companies, and hospitals to leverage the technical expertise, infrastructure, and regulatory preparedness of specialized service providers.

In the United States, the surge in personalized medicine, regenerative therapies, and biologics manufacturing is a core driver behind the expansion of the cell banking outsourcing landscape. Moreover, the U.S. is home to a strong regulatory framework governed by the FDA and supported by compliance structures like cGMP (current Good Manufacturing Practice) and GLP (Good Laboratory Practice). This, coupled with a robust funding environment, world-class research institutions, and a thriving biotech start-up culture, has positioned the U.S. as a global leader in cell banking services.

Outsourcing in this field is driven by the increasing complexity of cell characterization and testing protocols, high cost of infrastructure for in-house cell banks, and the time-sensitive nature of pharmaceutical product development. From basic bank storage and cryopreservation to highly specialized characterization and stability testing services, outsourcing companies cater to an extensive range of client needs.

Additionally, the increasing number of clinical trials using cell-based products, particularly for cancer, rare diseases, and immunotherapy, has intensified the reliance on professional service providers. The need for scalable, reproducible, and safe cell sources is driving demand for master and working cell banks across both stem and non-stem cell types. Furthermore, the evolution of induced pluripotent stem cells (iPSCs), genome editing technologies like CRISPR, and stem cell-based personalized treatments has amplified the importance of stringent cell banking systems.

Major Trends in the Market

-

Increased Demand for GMP-compliant Master and Working Cell Banks: Drug developers are increasingly outsourcing the creation and storage of cell banks to meet stringent FDA and EMA regulations.

-

Rising Popularity of Stem Cell Therapies: Stem cell-based clinical applications are on the rise, encouraging more stem cell banking services and customization.

-

Adoption of Automated Cryopreservation Systems: Companies are investing in robotic and AI-integrated cryogenic storage solutions to enhance consistency and reduce manual errors.

-

Expansion of Dental and iPSC Cell Banking Services: New niches such as dental pulp stem cells and induced pluripotent stem cells are gaining traction among consumers and researchers alike.

-

Growth in Gene Editing and Testing Services: Increasing integration of genetic testing such as sequencing and expression analysis in bank characterization.

-

Emergence of Virtual Biobanking Models: Cloud-linked traceability, remote monitoring, and data integration services are enhancing the outsourcing model’s flexibility.

-

Collaborations Between Biotech and Outsourcing Firms: Strategic alliances for joint development of cell therapy products and long-term storage contracts are becoming more common.

-

Commercialization of Cell-based Therapies: FDA approvals for cell therapies (e.g., CAR-T therapies) have prompted greater investment in cell sourcing and storage services.

U.S. Cell Banking Outsourcing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 6.04 Billion |

| Market Size by 2033 |

USD 20.89 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.79% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, cell type, phase |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Cryo-Cell International, Inc; Charles River Laboratories; Covance; GlobalStem Inc.; BioReliance; Sigma-Aldrich Co. LLC; Stem Cyte, Inc; ViaCord; Cord Blood Registry;SmartCells, Inc.; Cryo Stemcell |

Market Driver: Surge in Biopharmaceutical R&D and Cell-Based Therapeutics

A primary growth catalyst for the U.S. cell banking outsourcing market is the significant increase in R&D activities surrounding biopharmaceuticals and cell-based therapies. As of 2024, hundreds of investigational cell and gene therapies are in preclinical and clinical stages, with a large share occurring within the U.S. The shift towards precision medicine and targeted therapies, especially in oncology, autoimmune disorders, and rare diseases, necessitates the use of well-characterized and genetically stable cell lines.

Given the complexity, time sensitivity, and regulatory stringency associated with these therapies, organizations are outsourcing critical steps like bank preparation, safety testing, and storage to specialized vendors. This not only ensures quality and compliance but also accelerates the time to market. For example, companies developing autologous CAR-T therapies often rely on outsourced GMP-certified facilities to maintain cell line integrity throughout the production cycle.

Market Restraint: High Costs Associated with Characterization and Storage

Despite the promise, the U.S. cell banking outsourcing market faces constraints due to the high cost associated with cell line development, testing, and storage. Comprehensive characterization processes, including safety, genetic stability, and expression profiling, require sophisticated technologies and experienced personnel, both of which contribute to elevated operational expenses. Additionally, long-term cryopreservation under GMP standards entails investment in redundant power supply, security systems, temperature monitoring, and backup storage.

Small- to mid-sized biotechnology firms, particularly those in early-stage development, may find these costs prohibitive, especially when the therapeutic value of a particular line is still under evaluation. Furthermore, recurring compliance audits and updates in regulatory protocols (e.g., CFR Part 11 for electronic records) add to operational overhead for both clients and service providers. These factors may delay engagement or limit the scope of services outsourced.

Market Opportunity: Expansion of iPSC and Dental Stem Cell Banking

One of the most promising opportunities in the U.S. market lies in the expanding application of induced pluripotent stem cells (iPSCs) and dental pulp stem cells. iPSCs offer the ability to reprogram adult somatic cells into a pluripotent state, allowing them to differentiate into any cell type. This has revolutionized regenerative medicine, drug screening, and disease modeling. The need to maintain large-scale, reproducible, and genetically characterized iPSC lines has led many organizations to outsource cell banking functions to ensure optimal quality.

Dental stem cell banking, on the other hand, is emerging as a viable and consumer-friendly alternative to cord blood banking. With minimal invasiveness and increasing awareness among parents and families, the demand for dental pulp storage is rising. Companies offering these services often provide companion diagnostic and storage packages, further boosting outsourcing potential. These areas are poised for exponential growth as clinical trials advance and consumer demand increases.

Segments Insights:

By Type Insights

Master cell banking emerged as the dominating segment in the U.S. cell banking outsourcing market. Master cell banks (MCBs) serve as the primary source for all future cell production, ensuring consistent quality and genetic stability. Given the need for long-term, GMP-compliant repositories in drug development and biologics production, many companies outsource MCB preparation to specialized contract development and manufacturing organizations (CDMOs). These partners provide end-to-end services, including clone selection, media optimization, and extensive testing for contaminants and genetic aberrations. MCB outsourcing also minimizes the risk of supply chain disruptions during scale-up or commercialization.

Meanwhile, working cell banking is expected to be the fastest-growing segment due to its pivotal role in routine production and ongoing research applications. Working cell banks (WCBs) are derived from MCBs and used in various downstream processes such as batch manufacturing, assay development, and stability testing. As cell therapy commercialization expands, the frequency and volume of cell usage increases, thereby driving the need for secure, replenishable, and well-characterized working banks. Outsourcing WCB services ensures timely access to ready-to-use cells, adherence to batch traceability standards, and cost-effective scalability for pharma and biotech firms.

By Cell Type Insights

Stem cell banking dominates the market due to the therapeutic versatility and regenerative potential of stem cells. Among the subtypes, cord blood banking holds the largest share, driven by strong parental interest, pediatric applications, and increasing clinical evidence supporting its use in hematologic and immune disorders. Public and private banks across the U.S., including services like ViaCord and Cord Blood Registry, are collaborating with third-party vendors to manage storage logistics, testing, and regulatory compliance. Adult stem cell banking, including mesenchymal and hematopoietic types, also contributes significantly due to its application in autologous transplantation and regenerative procedures.

However, iPSC banking is the fastest-growing segment as academic centers and pharmaceutical companies continue to explore its transformative applications in disease modeling, gene therapy, and organ-on-chip technologies. The complexity of generating, characterizing, and storing iPSCs makes outsourcing an appealing option for most institutions. CDMOs provide expertise in reprogramming protocols, epigenetic screening, and viability testing. The need for standardized iPSC libraries for clinical and commercial use is pushing demand for large-scale, compliant cell banking solutions tailored to these applications.

By Phase Insights

Bank storage leads the U.S. market owing to its foundational role in maintaining cell integrity over extended periods. Facilities offering cryopreservation, storage audits, and stability verification ensure that cells remain viable and uncontaminated for clinical and commercial use. Master cell bank storage, in particular, commands significant investment due to its long-term strategic value. Biopharma companies often maintain backup facilities or mirror repositories to mitigate risks. Additionally, stability testing is increasingly being incorporated to evaluate the cell’s viability and functionality over time, a requirement under regulatory protocols.

In contrast, bank characterization and testing is the most rapidly expanding phase due to heightened scrutiny over genetic consistency, pathogen safety, and expression profiles. Gene sequencing and expression testing are being demanded more frequently to ensure that cell lines meet regulatory benchmarks and do not drift genetically during expansion. Safety testing for viral and microbial contamination is another critical component that outsourcing firms provide, often bundled into regulatory submission-ready documentation. As gene editing technologies advance, the importance of post-editing characterization is also increasing, bolstering demand for this segment.

Country-Level Analysis

In the United States, the cell banking outsourcing market is driven by its robust biotech ecosystem, a supportive regulatory climate, and a large base of clinical trials involving cell-based therapies. The country houses numerous globally recognized biotech clusters, such as those in Boston, San Diego, and the San Francisco Bay Area. These regions are home to both start-ups and established pharmaceutical companies that regularly outsource cell banking functions to reduce overhead and accelerate time-to-market.

Furthermore, the U.S. FDA has taken progressive steps in regulating cell and gene therapies under frameworks like the RMAT (Regenerative Medicine Advanced Therapy) designation, which fast-tracks eligible therapies. This has created a conducive environment for companies to partner with compliant CDMOs for their cell banking needs. Institutions like the NIH and academic hospitals are also increasingly engaging with third-party cell banking services to manage storage, testing, and preparation requirements for clinical trial samples.

The country’s investment landscape is equally favorable, with both public and private funding being funneled into cell therapy pipelines. Organizations such as the California Institute for Regenerative Medicine (CIRM) have funded multiple iPSC and stem cell research projects that rely on stable and safe cell banking infrastructure. This convergence of innovation, investment, and policy is ensuring continued growth and innovation in the outsourcing space.

By Recent Developments

-

February 2024: Lonza Group expanded its U.S. biopharmaceutical services by adding a new cell and gene therapy facility in Houston. This includes GMP-certified cell banking services designed to support early- to late-stage therapies.

-

November 2023: Cryoport Systems announced the launch of its enhanced biostorage solutions for stem cell and CAR-T therapies, integrating advanced AI tools to monitor cryogenic stability.

-

August 2023: WuXi Advanced Therapies, a subsidiary of WuXi AppTec, introduced a new suite of U.S.-based testing and cell banking services in response to growing demand for high-volume stem cell manufacturing support.

-

May 2023: BioLife Solutions acquired Global Cooling Inc., a developer of ultra-low temperature storage technologies, with the goal of improving scalability for outsourced stem cell and gene therapy banking.

Some of the prominent players in the U.S. Cell Banking Outsourcing Market include:

- Cryo-Cell International, Inc

- Charles River Laboratories

- Covance

- GlobalStem Inc.

- BioReliance

- Sigma-Aldrich Co. LLC

- Stem Cyte, Inc.

- ViaCord

- Cord Blood Registry

- SmartCells, Inc.

- Cryo Stemcell

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cell Banking Outsourcing market.

By Type

- Master Cell Banking

- Working Cell Banking

- Viral Cell Banking

By Cell Type

- Stem Cell

- Cord Cell Banking

- Embryonic Stem Cell Banking

- Adult Stem Cell Banking

- Dental Stem Cell Banking

- IPS Stem Cell Banking

- Non-stem Cell

By Phase

- Bank Storage

- Master Cell Bank Storage

- Working Cell Bank Storage

- Cell Storage Stability Testing

- Bank Characterization & Testing

- Safety Testing

- Viral Cell Banks

- Microbial Cell Banks

- Gene Expression Testing

- Karyology Testing

- Gene Sequencing Testing

- Bank Preparation

- Master Cell Bank Preparation

- Working Cell Bank Preparation